6 min read

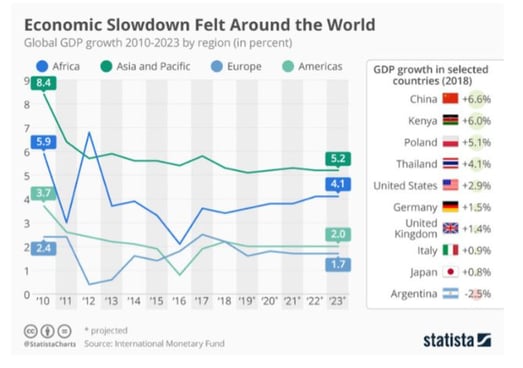

The news has not been let out, but the world might be on the verge of a recession since economies around the world are already slowing down. The global GDP growth has been slowing down as is evidenced by the chart below:

Since 2010, as countries waded out of the recession of 2008, they enjoyed economic growth. Coupled with technological innovation, the global economy really got a boost. But, mirroring Nature’s cycles, it seems it is now time to hit a plateau and slow down. In this article, we explore why the slowdown could be happening and more importantly, what it means for us in the insurance industry.

Why the slowdown

According to the World Economic Forum, the signs of a global slowdown are not only present everywhere but are also multiplying. These include the decline of manufacturing in Germany, Japan, the United States, and others. Even in China- a country which is rife with output year after year- the output has slowed. Other indicators of slowdown include the sustained inversion of the US Treasury yield curve, rising geopolitical conflicts, and the impact of tariffs.

On top of this, recent events such as Brexit, the Covid-19 pandemic and the war in Ukraine have all significantly enhanced the economic slowdown.

What about insurance? What is the recession's impact on the insurance industry? Whilst some general trends apply to insurance companies as well, there are some implications and unexpected results to dig into.

Effects of the slowdown on the insurance industry

In a 2019 Goldman Sachs Asset Management insurance survey, 41% of insurers said they agreed with the above reasons and expected a recession to occur by the end of 2020 or 2021 - which happened even more heavily with the unrolling of the unpredicted global events. Here’s what is generally expected to happen within the insurance industry every time a recession occurs:

1. There will be less demand

This is the first and most obvious effect. Since the economy is slower, fewer businesses and individuals have extra money to spend on insurance despite its importance. Even though it won’t hit rock bottom, the demand for insurance will go down and the market will become even more competitive. As mentioned in previous Spixii blogs, price doesn’t suffice to attract customers but should be paired with convenient and personal digital experiences.

Grab our most recent eBook for free ➜ and discover how Spixii leverages Conversational self-serve to increase operations and customer experience at once.

2. Increased pressure in settling claims efficiently

2. Increased pressure in settling claims efficiently

The money that the insured gives as premium payments, is invested by the insurance companies in real estate, other financial institutions like banks, mortgage-backed securities, and dividend-paying stocks. Now when the economy is doing well, the returns on these investments made will be good and insurance companies are less likely to challenge their claims settlement processes.

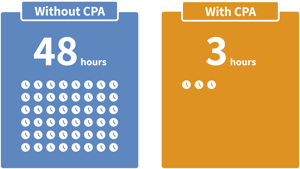

With a slow economy, however, the returns will decrease. Insurance companies will need to recover the invested money somehow. They will do this by taking a loan themselves, or by challenging their existing operations, especially the significant ones like claims. Settling claims efficiently is the solution. The first step is to categorise them into small claims that can be dealt with automatically and complex ones that require human intervention. This will avoid unnecessary delays in paying out claims and will provide much-needed control over cash flow.

Find out how insurtech Spixii helped Zurich UK to reduce claims settlement from 48 to 3 hours ➜

3. Companies will face more regulation

3. Companies will face more regulation

In the uncertain and gloomy economic climate, scrutinizing and patrolling of financial institutions becomes even more crucial. Stricter consumer protection laws are implemented to safeguard consumers from any exploitation by these institutions.

Insurance companies might find themselves being under greater scrutiny by the government through complex rules and elaborate procedures. This will mean extra expenditure on compliance and regulations.

This might deject innovator officers as more regulation usually implies less space for innovation. Is it always the case? Find out how Spixii's Conversational Process Automation platform enables innovation within a compliance framework ➜

Is the insurance industry recession-proof?

Specifically, how did the insurance industry perform during the recession in 2020? McKinsey's Global Insurance Report 2022 points out a 1.2% premium growth decrease in 2020, but also seems to suggest a positive recovery from 2021 onward with an increase in premium growth and profits. Does this mean that the insurance industry is recession-proof? No, it doesn't.

Today, more than ever, insurance companies are urged to adopt new business models in order to consolidate - like banks do - and avert some of the risks. They will have to rethink their own investments and credit evaluation procedures. New investment opportunities will also have to be looked into in order to keep the returns on invested premium payments, flowing.

It is imperative to plan new strategies so to ensure business continuity and efficiency. Many insurance businesses are already partnering with insurtech companies to enable automation for a more resilient and cost-effective operation. Such companies not only are able to offer superior services to their customers but also establish a continuous process improvement loop.

For example, Spixii partnered with a large international health provider and help them to deliver immediate automated decisions for medical pre-authorisation. Discover how the new solution reduced the interaction time from 40 to 2 minutes ➜

How to start preparing for future recessions

How to start preparing for future recessions

The trademark sign of a slowdown or recession is the fall in demand. And no matter the type, each industry is affected by it. For each industry, though, the modus operandi remains the same: try to find a balance.

As per the chart, in the beginning, businesses have enjoyed economic growth for almost 10 years now. Technological innovation did change consumer preferences and brought up new communication with operational challenges for businesses. But, overall, demand has increased due to which so have profits, revenues, and competition. The positive environment has led businesses to either take risks and expand their expenses beyond what is sustainable or let complacency dominate and lead to poorly performing processes.

These extremes need to be avoided by businesses.

Business leaders have to find ways to cut down on as many unnecessary expenses as possible. This does not mean outright headcount reduction or asset divestitures, but rather cost and operational efficiency, coupled with designing and implementing new business models. But this is only the first half.

To strike a balance, the second half also needs to be implemented: generating revenue. This is why technology, people, products, markets, and decisions that promise growth and sustainability in the future need to be continually invested in. Currently, they are committing capital but are being extra careful with the risks they take. They are also allocating to less liquid assets like middle-market loans, infrastructure debt, and private equity.

Business leaders have to practice discretion here and spend more time thinking through their risks. Cast a wide net and ask: what will the people of the future need? Which market segments will dominate? For insurance companies, this might mean investing in the millennial market, scaling up travel insurance, and using Spixii solutions for keeping up customer satisfaction (customer retention and increasing the perceived brand value will pay dividends when things go bad).

It often happens that leaders, CEOs, and management is turned upside down during slowdown periods. Many tend to perform well during one period but not the other. The best leaders, however, do well during both. That should be the standard that each leader aspires to.

The slowdown is happening. But, there are ways to prevent its effects from now. The best course of action is to begin reverse engineering and adapt as best as possible. This, too, shall pass. In the meantime, you can download a copy of the most recent Spixii white paper here below to understand the specific challenges for the insurance industry and get tangible insight on how an insurtech solution can help overcome them ⬇⬇⬇