The Spixii Conversational Process Automation (CPA) Platform provides a secure and scalable framework to deliver superior customer experience while improving the resilience and performance of business operations.

The Spixii platform is suited for P&C, Life and Pensions line of businesses from quote & buy, policy administration to claims

The Spixii platform is designed to enhance chatbots performance by collecting empirical data from the users and adapting to their evolving needs

The Spixii platform was built in accordance with the GDPR ensuring data privacy, data sensitivity and compliance

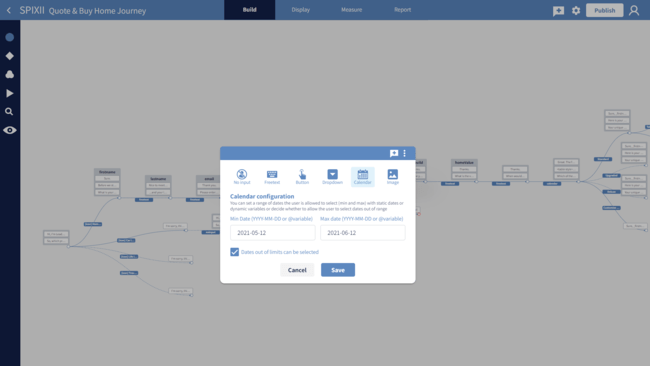

Easily create personal and engaging chatbot conversations in a few clicks through a flexible and intuitive low-code interface

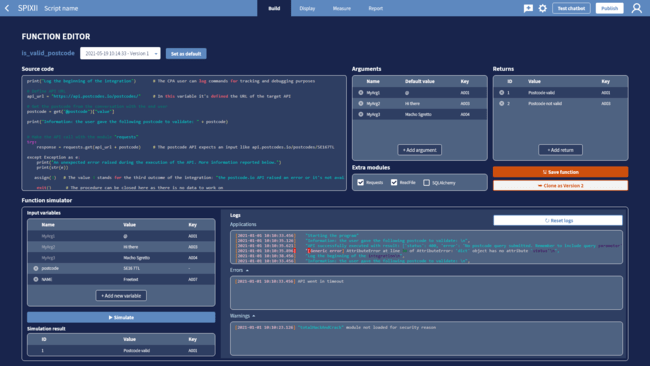

Assign logic to your chatbot and connect it with your system leveraging Spixii smart functions or creating your own directly from the platform

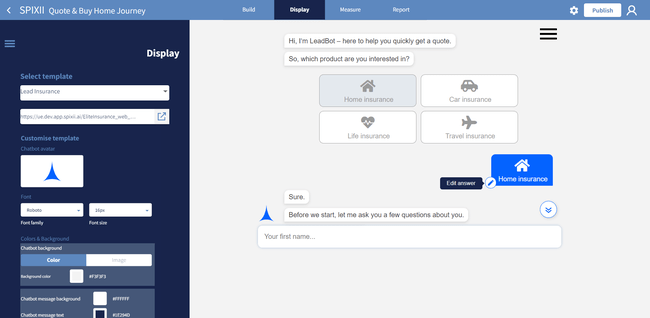

Offer a unique experience by customising the look and feel of your chatbot and aligning it with your brand guidelines

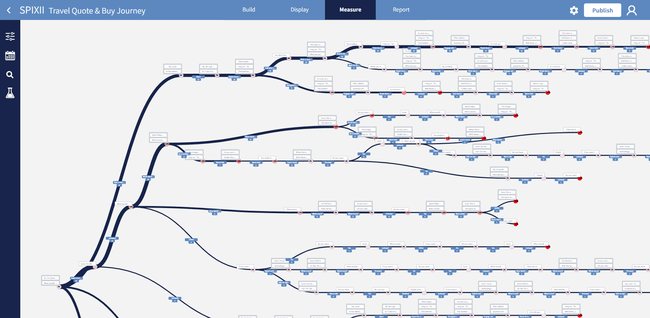

Get data-driven insights over your chatbot performance and acquire customer knowledge through behavioural analysis

Is your organisation leveraging automation for customer-facing processes? Take the first step toward automation and evaluate if Spixii CPA Platform can boost your customer-facing processes by building a meaningful Proof of Value. Demonstrate potential business value with low effort.

Spixii CPA platform is designed for insurance and financial services. It can be configured by our team or consulting partners from design and branding to monitoring and support.

The Spixii platform is cloud-native and can be enabled by the cloud provider of your choice. Using container technology, on-premises deployment is possible.

We base our system on the most reliable, scalable and secure architecture to create a stable and safe bridge between customers and your legacy system. All personal data are flowing straight to the protected central vault.

Spixii intelligent chatbots are secure with bank-level encrypted communication channels for both front-end and back-end integrations. At the core of the architecture, the conversational data are processed by Oracle Database technology.

Increase revenue and customer satisfaction by offering the most comprehensive, flexible and personal customer journey for non-advised yet guided insurance sales

Bring in conversational process automation by providing your customers with self-serve capabilities from renewals, mid-term adjustments and premium collection

Award-winning solution, Spixii Claim provide an immediate response to your customers 24/7/365, straight-through processing capabilities and ability for your processes to absorb surges

Discuss your business needs with the Spixii team and discover how the Spixii CPA Platform can help you accelerate the automation of your high-value processes.