Spixii enables regulated businesses to solve high-value requests with self-service that are 100% accurate

Based on a human-to-human conversation, call centres provide a good overall experience, particularly for complex or very specific customer queries. Yet, they are vulnerable to surges, which often coincide with higher volumes.

The most expensive channel, implying hiring, training, office rental, software and hardware costs. While there are ways to reduce operating costs, such as proper agent training and practical guidelines, the overall bill is high and keeps increasing.

To avoid business risks by going off track, agents follow scripts when interacting with customers. Therefore, a significant amount of effort is spent on training, reporting and auditing conversations leaving little room for improvement.

Webforms can help regulated businesses save money by enabling customers to buy a simple policy or make a claim online. Yet customers often end up calling to complete an insurance purchase or file a claim, adding to the call centre's workload.

Web forms provide a dry, impersonal, and untailored customer experience, often unlinked to the business logic of regulated processes. In addition, they struggle to deliver a user-friendly customer experience across all devices.

Complex processes required to cover multiple scenarios that are clunky to represent with various screens or blocks using webforms. Accessibility accross multiple devices is onerous to maintain with webforms cancelling the costs gains.

Some requests, such as opening hours, directions on where to find a PDF document, or customer service contact details, can be used by GenAI without being detrimental to regulated businesses. if the answer is not 100% correct.

Despite the generation of answers in credible language , the quality of the answers is not 100% accurate. It is a system generating an unchecked answer which is time-bomb for raising compliants and creating uncontrolled operations.

Staying on top of GenAI means adopting new models and aggreation of models constantly. It creates risks in terms of data governance, it consumes unecessary that are hard to justified if the processes automated are of low-value

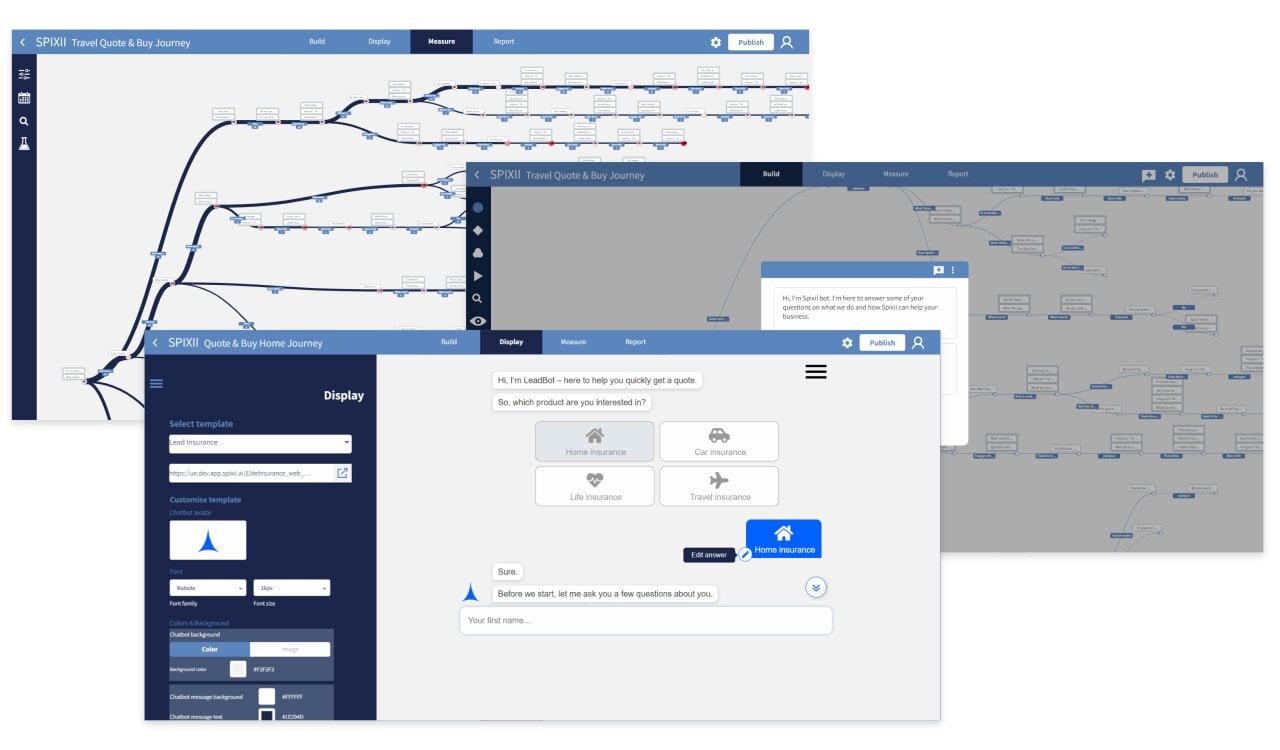

Spixii platform creates expert chatbots to deliver personal, immediate and efficient conversational experiences. Customers can self-serve without waiting and still enjoy the personal touch of a guided, tailored conversation to obtain a clear outcome.

Reducing the interaction time for high-value processes from 10 to 20 times, the Spixii platform frees up precious time for both agents and customers. More power to the customer, more time to agents to tackle complex cases.

Through the platform, organisations have total control over their conversational process and can promote changes within hours. From the conversational flow to the chatbot interface, businesses can update their service safely and quickly.

Interactions with individuals generate valuable conversational data (digital footprints of each journey) and process data (aggregated performance view) for continuous improvement while being compliant with easily auditable journeys.

No need to start from scratch: conversational processes can start with a ready-made skeleton. By leveraging Spixii's library, businesses can start from an existing conversational template and customise it in a few clicks.

Spixii platform provides no black boxes. The control of the conversational processes and integrations is entirely in our clients' hands. Spixii Function Manager allows custom code input, opening the door to robust connections with systems.

Is your organisation leveraging automation for customer-facing processes?

Are you ready to boost your customer-facing processes with Conversational Process Automation (CPA)?

Take the first step toward automation and claim your Spixii Performance Assessment for free.

Call centres provide an overall good and personal user experience yet they saturate quickly causing customers to wait. No one likes waiting and complaints are inevitable and ultimately damage the reputation of the brand. The only way to overcome this problem would be to have one operator per customer, which is not viable business-wise.

Webforms and portals provide a good business performance by leveraging digitalisation to automate processes that were once performed manually. Yet webforms lack the personal conversation of call centres reducing them, essentially, to digital monologue. Customers today expect more than impersonal and clunky interactions.

Web live chat empowers human agents to manage multiple personal conversations at the same time. It empowers and scales call centres. Yet, each agent can manage a maximum number of 4 conversations causing long waiting times. Web live chat suffers from the same constraints as call centres, it only raises the threshold higher.

CPA allows the optimum customer experience by preserving the personal conversation yet delivering it digitally at scale. CPA enables an illimited number of personal and consistent conversations at a fraction of the cost of the analogue ones.

Still requires an in-house expert to deploy the solutions, which insurance organisations usually don't have, resulting in partnering with large consulting or IT companies, which makes the project expensive and less agile, and risks irrelevance when live.

The average lead time for IT teams to tailor or customise further an existing solution on their own is between 6 and 12 months. The cost of maintaining a typically inflexible solution is significant, leaving no time and resources for continuous improvement.

Relying mainly on Natural Language Processing (NLP), the generated conversations are free-flowing and do not follow a business process with 100% accuracy. The operational and reputational risks for businesses are very high, resulting in automation of only low-value processes.

> 70 TNPS with an all-inclusive SaaS platform that continually expands through the latest security upgrades

Set your automation goals and achieve them with low effort using a nimble low-code interface*

*Our clients reach 50% automation rate within 3 months. Try to beat it!

3x time faster process iteration informed by unique and detailed conversation analytics

From core systems to RPA, Spixii partners with the leading technology providers to offer end-to-end digital solutions.

Spixii partnered with Appian to offer insurers an embedded solution that enables straight-through-processing (STP) and no-touch claims automation for P&C, Health and Life insurance.

Socotra provides open APIs, a product-agnostic data model, and out-of-the-box capabilities to manage the entire policy lifecycle, making insurance innovation faster, easier, and more affordable.

Blue Prism develops leading Robotic Process Automation software to provide businesses with a more agile virtual workforce. Spixii complements it through the automation of conversations.

Discuss your business needs with the Spixii team and discover how the Spixii CPA Platform can help you accelerate the automation of your high-value processes.