Get data-driven insights over your chatbot performance and acquire customer knowledge through behavioural analysis.

All the data and customer feedback collected through Spixii Intelligent Chatbots flows into Spixii Insight Hub, where it gets structured and displayed in a meaningful and visual way through graphs and dashboards.

This module enables insurers to get sense out of data and generate insights over their customers and process improvements through advanced conversational analytics and behavioural pattern analysis.

Share insights about your customer to the various functions of your organisation fostering a customer-centric approach

Enrich the knowledge base of your customers to offer personal experiences and refine the uniqueness of your proposition

Analyse when users are getting stuck and dropping off the conversations to find out the next improvement

Spixii Insight Hub is designed to uncover customer behaviour insights.

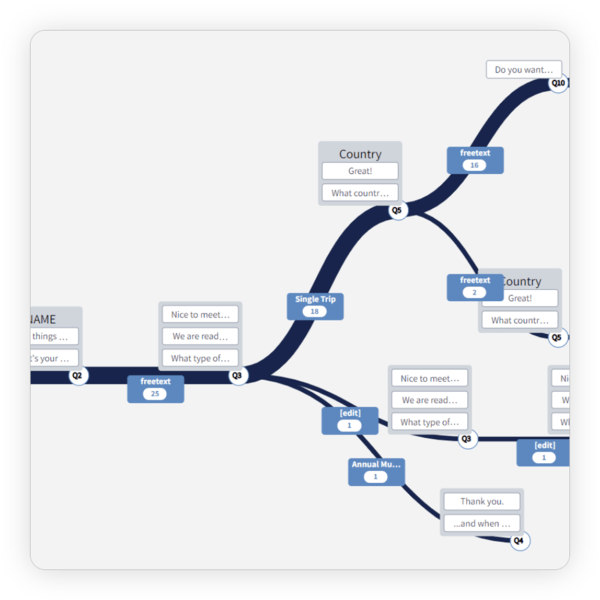

In order to do so, this module unwraps and plots in real-time all the chatbot conversational paths whilst highlighting the most recurrent through volumes (thickness of the line).

Through this feature, insurers have the exact overview of the chatbot usage together with the conversational experience of every customer.

The graph helps insurers to see at a glance which conversational paths are most used.

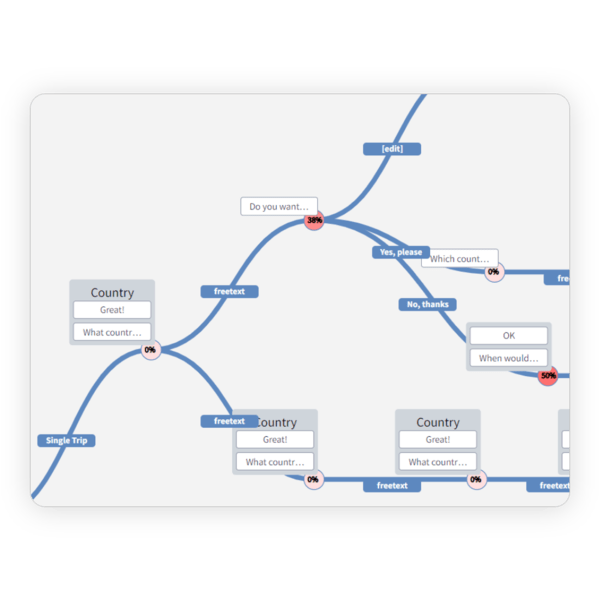

Spixii Insight Hub uncovers the most critical parts of the conversation through the drop-off rate analysis.

Especially for highly transactional insurance processes such as Quote & Buy, this metric is key, as it represents the percentage of users that leave the chat at a specific point of the conversation.

Through this feature, insurers are given suggestion on the specific areas of improvement, at a message level, by making them visible at a glance (highlighted in red).

Is your organisation leveraging automation for high-value queries?

Take the first step to boost your customer service operations by augmenting the execution of a high-value process with 24/7 conversational self-service.

Demonstrate potential business value with low effort.

To help insurance businesses analyse how customer interact with their chatbots and make informed data-driven hypotheses, Spixii Insight Hub also provides timestamp information.

Thanks to this feature, insurers can see how long does it take for a user to go from one chatbot message to the next.

Also, the wait time is available with a breakdown that differentiates the technical time for a chatbot to display messages and the actual user response time. Such information can help identify critical nodes and explain their performance: it might happen to have a heavy integration with high loading time causing users to walk away from the chat, or it might be the text of a chatbot message very difficult for users to process.

Both quantitative and qualitative (e.g. customer feedback), all the data coming from Spixii Intelligent Chatbots are summarised at a higher level through dashboards.

Highly flexible and customisable, dashboards are available from the Spixii CPA Platform and made of assets specific to the processes created. The dashboard is normally set up at the beginning of every collaboration.

In addition, data can be exported in the most convenient format (e.g. CSV, XLS) or connected with Power BI real-time streaming to allow insurance businesses to integrate with their reporting functions and systems.

Spixii masters data governance with the adoption of data minimisation and anonymisation strategy to ensure sensitive data is unidentifiable to an individual or entity. Spixii data stack is based upon Oracle Database with flexible data retention policies.

Through the adoption of fine-grained access control (FGAC) frameworks, Spixii CPA Platform empowers insurers to control and set different data access for their employees or third party companies according to their function and their level of responsibility.

Spixii CPA Platform data handling ensures alignment with general data protection (GDPR) guidelines but more strictly to the insurance distribution directive (IDD) and financial conduct authority (FCA) as well.

Leveraging Spixii’s machine learning capabilities, focusing on real customer historical and transactional data, identify risks and opportunities related to your business.

Easily create personal and engaging chatbot conversations in a few clicks through a flexible and intuitive low-code interface

Assign logic to your chatbot and connect it with your system leveraging Spixii smart functions or creating your own directly from the platform

Offer a unique experience by customising the look and feel of your chatbot and aligning it with your brand guidelines

Discuss your business needs with the Spixii team and discover how the Spixii CPA Platform can help you accelerate the automation of your high-value processes.