3 min read

Gone are the days of interactions where customers and businesses would have to come face-to-face for a transaction. Thanks to the mighty powers of the internet, almost everything can now also be done online. Customers, too, vastly prefer the digital medium and businesses have skilfully accepted the task of curating digital experiences for them.

At the same time, there is pressure to provide not just some digital experiences but good ones. Financial services are slow in transitioning to delivering better digital experiences for its customers and FinTech and InsurTech are helping large companies do that.

Now, the major challenge is to find ways to deliver good customer experiences in a sustainable way, with contained cost and streamlined processes. In other words: how to provide good experiences whilst optimising operations and processes?

Case in point: insurance industry’s journey to digital

Insurance has always been based on conversations between an individual and an insurance assistant or operator. In other words, we can say insurance has always been a conversational experience. This is true for every stage of the life cycle: when enquiring, purchasing, servicing, or claiming an insurance product, an exchange of information and a proper conversation is happening.

Initially, the technology opened the door to enhancing business and operational efficiency. For retail insurance, call centres became the typical point of contact, and new opportunities started to appear with the first websites and web forms. This opened the door to an entirely new and digital experience. Yet, web forms are a simple data capture tool without interactions, turning the experience into a monologue.

The journey has now switched into higher gear, as McKinsey highlighted in their report Elevating customer experience: A win–win for insurers and customers, "Insurers must find a way to meet the needs of an increasingly diverse and digital customer base—or they risk watching their customers leave.'

The rising of customer expectations

Today, customers demand more. After many years of impersonal interactions and confusing online experiences, customers started to complain about it.

This is also because major players from different industries that are excelling in great digital experiences (e.g. Amazon, Netflix, Zalando, etc.) not only reaped the fruits but also increased overall customer expectations in other industries, including insurance. Digital has now become ipso facto the first point of contact with a customer or policyholder. As per Deloitte:

“Insurers need to find ways to balance technology adoption with maintaining the human touch. Insurers are increasingly dependent on emerging technologies and data sources to drive efficiency, enhance cybersecurity, and expand capabilities across the organization. However, most should also focus on improving the customer experience by both streamlining processes with automation as well as providing customized service where needed and preferred.”

Financial Services customers want personal and human interactions, therefore, it obviously becomes a huge competitive advantage to meet their new expectations.

In short, it’s time to restore the conversational nature of financial services, as conversations remain the preferred method to convey complex information. Financial products complexity demands a conversational experience at every stage of the life cycle.

Marrying digital conversations and business operations

The delivery of financial products is made of conversations. Such conversational processes can be automated in the digital space. In 2016, chatbots and Conversational Process Automation (CPA) platforms started to appear as a bridge between the digital conversation and the business operations world.

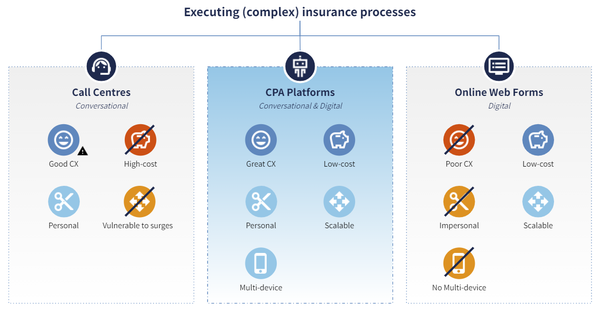

While call centres provide an overall good customer experience at a high cost, online web forms provide good operational efficiency at the cost of a bad customer experience. CPA platforms enter the market to optimise both.

With CPA platforms, it is now possible to create new conversational experiences powered by chatbots and integrated with core business systems, policy, claims or underwriting systems. This means keeping the conversational nature of financial services interactions with a personal touch, yet delivering them at scale 24/7/365.ind out more about how to evolve conversations with customers from analogue to digital.

The way forward

“If you are not taking care of your customers, your competitor will.”

– Bob Hooey

There is no other way businesses work in the 21st century. Your business either brings the best to your customers or they switch the relationship with your business to a better one. Conversational Process Automation has the power to ensure that customers have access to the most powerful self-services. It’s time to offer them the best experience while boosting your business operations.