8 min read

To avoid loss, automation needs to service the customers better and not become a barrier to communication with the financial services provider. Done well, automation can channel customers to the right place. Done badly, as can happen with Interactive Voice Response (IVR), customers can wait 20 or more minutes to be connected with someone who is not the expert they need to speak with, so they end up being transferred to another person. Being pushed from pillar to post and waiting on the phone for too long creates a bad experience.

Leverage Self-service and Conversational Process Automation to improve the customer experience and operational efficiency, read Spixii’s eBook on ‘How to enable true self-service in insurance’ with Conversational Process Automation and Conversational Self-Service Technology.

To prevent this from happening it’s vital to set expectations by asking customers the right questions and ensure their waiting times are significantly reduced. As of 2024, ContactBabel, a research firm ran a survey with more than 200 call centres and one key finding on waiting time is "the average speed to answer is its second-highest recorded level in the past 20 years, at 116 seconds."

Customers want a quick resolution to their issues, whether through buying an insurance product or talking to someone to resolve a problem with their insurance policy or contract. Customers want to be able to quickly and immediately access claims updates, and they want to find the answers to their questions.

Renaud Million - CEO and Founder of Spixii - says they will use other channels if their experience through one particular channel, such as IVR or even a web chat is not good. At worst, they will jump ship to buy a competitor’s insurance products. Expectations have to be set appropriately to ensure this doesn’t happen and keep each customer happy.

At the end of the conversation, to ensure customer satisfaction is maintained and to allow for continuous improvements, the conversation should end with the question: “How likely are you to recommend us to others?” By setting expectations, and by connecting, even the approach behind IVR can be empowered to do what the end user wants to do.

Improving conversations with customers through automation

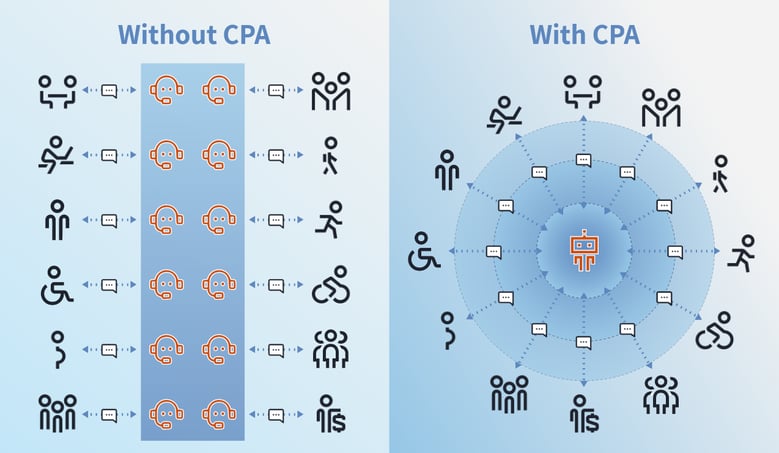

With automation, businesses can have more conversations with customers. Million says, “When it occurs on the phone, they can have only 1 conversation at a time, and with automation the number of conversations is unlimited.” Automation, therefore, permits businesses to increase the number of conversations they have with more customers, this is critical for claims operations, especially during a surge created by severe weather events.

Conversational Process Automation: marrying CX with business growth

Conversation Process Automation should put people first by interacting with them how they want. Ideally, this entails eliminating waiting times and having an empathic tone. Businesses also need to collect data on each customer interaction, including experiential data, to give qualitative feedback and to allow structured ongoing improvements.

Automation can create a competitive advantage for businesses because Conversational Process Automation, and automation more generally, is about doing more with less. It encompasses serving customers, putting more services online while using fewer resources, and opening up new opportunities to sell new products and services to customers. If customers are happy, they will come back and buy more products and services.

How to enable self-service?

To enable self-service there are technological, cyber-security, legal and regulatory compliance considerations to bear in mind. The technological requirements need to address any implications that may arise from poor security on customer and partner relationships by focusing on prevention rather than on reacting to a cyber threat in a way that requires a cure. With cyber threats becoming ever more sophisticated, cyber security needs to evolve.

Million explains:

“All the management of the information has to also comply with GDPR. The interface has to be secure. It’s key to encrypt this communication channel. Insurers are risk-averse, and if the technological partner causes any security concern, they won’t want to move forward. Certified ISO27001:2022, Spixii deploys automation with a focus on security and compliance to make insurers comfortable with innovation.”

Evolving cyber-security

For example, whenever a message or media is entered by the user in the chatbot, the conversational process checks with validation rules and an anti-virus program before processing further the data.

“Every entry point in the chatbot requires a checkpoint to ensure that there aren’t any viruses or lines of code that could trigger anything in our systems, and there is a need to protect insurers against more and more sophisticated cyber-security attacks,” says Million.

SaaS platforms enterprises use need the flexibility to grow and be secure. Spixii advises that data must be secured, and it needs to be backed up at a disaster recovery site. For financial services providers, it’s vital to have good IT architecture that can scale, and that architecture must allow for flexibility to enable volume when it comes and drops.

“Spixii does penetration testing quite regularly, and we have invested a lot in IT security to ensure that we have the ISO27001:2022 certification for information and security management.”, says Million.

Conversational self-service deep dive

This technology aims to make complex and high-emotion enquiries accessible and available to consumers. Digital, automated, and natural, it’s easy to interact with it because it’s simply conversational. It’s also intuitive and personal. It embraces data and continuous improvement, which can be achieved by analysing the key KPIs and conversational paths.

To enable improvements, conversational self-service gives businesses access to the data. This is vital because customer behaviour is evolving, and so processes may need to change. Some processes may not be equipped to deal with certain queries or levels of query. However, change shouldn’t just be for the sake of change. When things are being done efficiently and quickly, there is no need to change. Therefore, insurers should always measure and analyse their process to improve the customer experience, and to make their operations more efficient. It’s healthy to keep measuring.

Example: Spixii & Conversational Process Automation

The work we have been doing with Spixii has given us some real insight into what innovative technologies can bring to insurance. Making the process of buying and using insurance products easier, and making customers' experiences far better.

John Moore, Director of Bupa's Customer Lab

Bupa wanted to deliver a strong online customer experience while increasing operational efficiency. Bupa selected Spixii for its Bupa Blue Table innovation programme, during which Spixii delivered a fully integrated proof-of-concept, quote-and-buy chatbot.

Bupa set out to explore the potential of chatbot technology to return a conversational element to their digital customer journey. With Spixii it reviewed the existing Bupa digital customer journey, for those looking to buy or get a quote for health insurance. The teams worked together to break the journey into its constituent parts, piecing it together using plenty of post-it notes. They reviewed the customer information required to generate a quote and then created a conversation that elicited this from the customer, in an interactive way. Then the conversation was created and validated through testing.

Given the regulated nature of insurance in the UK, the teams engaged in a series of reviews with Bupa's compliance, legal, marketing and product teams, iterating the conversation and digital journey. In parallel, Spixii’s technical teams integrated the chatbot prototype with Bupa's backend and frontend systems.

"Our customers are our top priority, so there are multiple safeguards and measures we wanted to implement to ensure they are protected," says Richard Cohen, Actuarial Lead for Bupa's Customer Lab. "We refined the conversation to the requirements of our legal and compliance teams, and asked, 'How do you [the customer] want the conversation to be structured?' I really do see the future of this conversation as having a dialogue with the customer. So, let's start a conversation!"

To build a strong architecture, aligned with the requirements of this solution, SPIXII has leveraged the benefits of the AWS Services including EC2 instances, Oracle databases, Load balancer, RDS, CloudWatch and VPN Gateway to facilitate interconnections between the conversation solution and the payment interface.

The resulting chatbot provided a user-friendly messaging interface, which gave customers a guide price, before working through a more detailed conversation to understand their preferences for different product features, in order to provide them with a more precise quote.

The chatbot was hosted on the Bupa UK website and available to around half of customers visiting the website during the pilot. It provided access to additional information, to help the customer better understand the product features. The chatbot gave further insights into Bupa's customers, giving them the opportunity to express detailed feedback in real time. The chatbot's rapid development, integration, and iteration saw a much faster product development cycle than usual.