4 min read

The COVID-19 pandemic has shown the necessity of business resilience to survive. It affected every industry you can imagine, but some were affected the worst, and insurance was one of them.

Insurers felt the impact of COVID-19 through weaker premium growth prospects and volatile capital markets. In such difficult times when consumers are less likely to purchase insurance, insurers must implement changes that will reduce their operating costs.

This week’s blog’ll discuss the major challenges that increase costs and how conversational process automation can help solve them.

Problems for insurers

Every industry has its unique challenges, and insurance isn’t an exception. Following are the main problems insurers face in the current times.

High operating costs

Insurance companies have always had relatively high operating costs. A McKinsey report found that Operations and IT accounts for around 50% of a typical insurer’s cost base. Specifically, it accounted for 47% of the operating costs in life insurance and 61% in P&C insurance.

Why do insurers have such high operating costs? It’s primarily because of the preeminence of complex legacy systems and ecosystems that lead to high IT costs and low productivity.

A fragmented legacy IT landscape is often a root cause for failing to leverage economies of scale, driving high IT costs and mushrooming operational expenses. The McKinsey report also found that many insurers expressed concern about the lack of support offered in IT.

High operating costs reduce the profit margins for insurers and make it difficult for them to offer affordable products. Moreover, they prevent insurers from spending their resources on sectors that facilitate growth, such as marketing and research.

Reliance on traditional channels

Another prominent issue that affects insurers’ growth is their reliance on traditional channels such as phones, emails and man-powered web chats to interact with customers. The traditional communicable channels were created to reduce costs and increase operational efficiencies but have become very expensive. Relying on them as a main source to execute high-value processes is difficult at this point.

There’s a lot of room for improvement with traditional communication channels. Take call centers for example. The interaction between an operator and a customer is usually good through them, but a call centre can easily get saturated, forcing customers to wait.

A HubSpot research found that 33% of customers are most frustrated by having to wait on hold while being connected to an agent. The average waiting time is around 2 minutes. Volume for call centres varies greatly on a day-to-day basis, and the call centre is usually fixed in terms of the number of available agents. Hence, the cost per call is very high during the days with few calls, while it’s lower during the days with numerous calls.

However, on a day with few calls, the call centre would handle calls quickly, while on a day with multiple calls, customers would have to wait on hold, adding to their frustration.

We can also look at web forms. Webforms seemed like a unique digital solution to customer service problems a few years ago, but they have become obsolete over time. They bring a primitive level of automation by collecting customer data without human intervention.

Within financial services, the business rules and logic change quite quickly along with GDPR requirements. There is a need to mirror these changes in websites and web forms, which aren’t very flexible and require a significant amount of time and effort to implement.

Moreover, trying to create a conversation using a webform is simply impossible (due to the lack of two-sided conversations). In contrast, a meaningful conversation can easily solve most of the complex and high-emotion queries.

How to solve these problems?

We have looked at the various problems insurers face. Now, we’ll look at how we can tackle these issues:

Streamline IT ecosystem and processes

We have seen how operations and IT take up most of the operating costs of an insurance enterprise. Hence, by enhancing the company’s IT implementations, we can easily reduce operating costs and improve profitability.

The first step is to pinpoint and tackle the most inefficient processes with an in-depth analysis of the underlying technology to execute them. Often, inefficiencies are due to legacy systems or processes consolidated over time without critically reviewing their performance.

So, by reviewing their performance and identifying the most inefficient processes, insurance companies can address this problem more thoroughly by using RPA or modern core platform equipped with APIs.

It is proven that on top of savings from landscape renewal, lean IT projects typically reduce costs by 20 to 40 per cent and cut errors by a quarter. State-of-the-art technology can handle part of insurance processes or even entire one end-to-end.

Leverage automation

Instead of relying on obsolete communication channels, insurance companies can use modern automation solutions such as Conversational Process Automation.

Conversational Process Automation implementation allows lean communication with customers while giving structured data to businesses. They ensure two-way communications at a fraction of the cost through automation, and hence, more efficient than call centres or web forms.

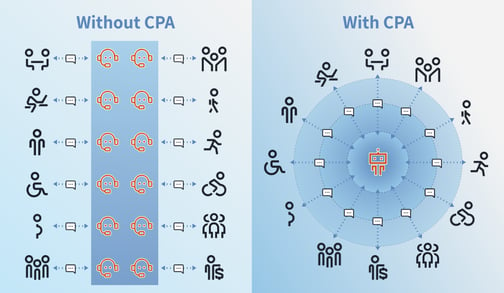

Managing different customer queries with and without Conversational Process Automation

Moreover, when linked to core processes or technologies such as Robotic Process Automation (RPA) systems, solving some customer queries wouldn’t require human intervention, offering significantly more efficient service than conventional communication channels.

For example, if we look at the claims of any major event (e.g., flood, heavy snow, and wind) we observe that call centres suffer from surges. An insurance chatbot would absorb such surges 24/7 all year round and perform automated settlements with CPA support.

Everyone knows that the faster the claim settlement, the lower its severity would be on the insurance claims handling costs.

Additionally, new and robust technologies require a small investment to train employees exposed to them while offering an increased ROI in the long run, thanks to the lower IT maintenance costs.

Conclusion

There could be many factors contributing to high customer service operations costs, but it’s clear the elephant in the room is legacy technology coupled with the expensive execution of high-value processes using phones or emails. Thus, it’s imperative that businesses diagnose their core processes, identify inefficiencies and consider the options that unlock a leaner execution. Automation offers a no-brainer solution. Learn more about Conversational Process Automation here.