6 min read

Today, vulnerability is one of the most discussed topics in the insurance industry and one that will demand the most drastic changes for insurance firms.

COVID-19 gave the final push that increased the relevancy and need for addressing the concerns of the most vulnerable demographics. According to the FCA’s Financial Lives 2020 Survey, the pandemic has augmented the need to take action as it significantly increased the number of vulnerable customers in the UK since February 2020 by 15%. There are now 27.7 million adults with characteristics of vulnerability, meaning more than half of the adults population (53% to be exact).

These figures are enough to explain the FCA’s concern about protecting vulnerable customers. The Authority is planning to finalise a new guide in Q1 2021, sharing the types of actions firms should take to understand and respond to vulnerable customers’ needs. After the release of such guidance, the FCA will monitor how firms are treating vulnerable customers and hold them to account.

Download Spixii's one-pager report here for information about FCA's 2021 requirements and how you can meet them.

Additionally, technology is changing how consumers interact with financial services. More and more consumers are switching away from traditional channels to embrace digital solutions. As an insurance business, have you thought about leveraging technology to meet the needs of your most vulnerable consumers?

If you haven’t, then this post will reveal how chatbots and Conversational Process Automation (CPA) can help insurance firms to adequately care for their vulnerable customers while meeting all new FCA requirements.

Defining vulnerability

Every business should be aware that on a daily basis, very different people are dealing with them. Different people means different needs, for example, the experience of making an insurance claim will be drastically different for a deaf person as opposed to a non-deaf one.

Even with a niche, a company can be thought to have as varied a population as a country

Among all the varied customers, FCA defines the vulnerable customers as follows:

...Someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care. [...] Vulnerable consumers may be more likely to have additional or different needs which, if not met by firms, could limit their ability to make decisions or to represent their own interests. So, the level of care that is appropriate for these consumers may be different from that for others.

As per the aforementioned survey, 46% of UK adults fitted the above definition and showed one or more characteristics of vulnerability.

Vulnerable demographics

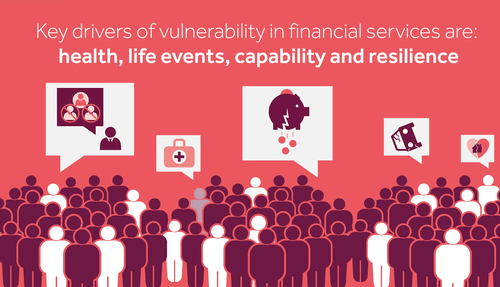

Image by FCA

The FCA determined these drivers and included specifics about which populations are deemed vulnerable in their survey. These are:

Adults with poor mental health or low mental capacity or cognitive difficulties:

- 42% of these people found dealing with customer services on the phone confusing or difficult;

- 34% were anxious when shopping around for financial products and services;

- 33% put off dealing with financial matters, such as ignoring warning letters, and;

- 29% had fallen into debt because they had not wanted to deal with difficult financial situations.

Adults with a physical disability

- 33% of these people faced difficulties getting to a bank branch, while

- 30% found dealing with customer services on the phone confusing or difficult.

Adults with a hearing or visual impairment:

- 40% of these people found dealing with customer services on the phone confusing or difficult;

- 38% faced difficulties getting to a bank branch, and;

- 25% struggled to follow instructions which makes it hard for them to interact with financial services providers.

Adults who had a relationship breakdown in the previous 12 months:

- 20% of these people had fallen into debt because they did not want to deal with difficult financial situations, while

- 20% struggled to manage their money.

Adults with low capability about money and finances:

- 57% of these people felt nervous, overwhelmed or stressed speaking to financial services providers or found it hard to find suitable financial products or services;

- 37% struggled to assess financial products or found it difficult to shop around, while

- 16% had fallen into debt which might have been avoidable if they had understood their options better.

Additionally, one in four (25%) have experienced at least one service-related problem with any financial services provider – including a problem getting through to them (11%) and issues using providers’ websites (9%).

Considering the extent of the problem, it is no wonder that the FCA stated:

"We want vulnerable consumers to experience outcomes as good as other consumers and to receive consistently fair treatment across the firms and sectors we regulate.

Firms must treat vulnerable customers fairly to comply with the principles of businesses. Firms need to do the right thing for vulnerable consumers and embed this in their business model, culture, policies and processes."

The power of CPA in helping vulnerable customers

We put together FCA’s high-level vulnerability principles and the concrete ways in which chatbot technology and Conversational Process Automation (CPA) can uphold those principles and meet requirements. Below is what it looks like:

|

What firms should do (FCA requirements) |

How CPA and chatbots can help |

|

Understand the needs of their target market / customer base |

CPA is designed to capture customer needs through chatbot conversations and offer businesses insights on customer demographics and behaviour, plus direct customer verbatim feedback. |

|

Ensure staff can recognise and respond to the needs of vulnerable customers |

CPA can easily identify and highlight vulnerable customers based on the chatbot conversation that took place and label such interactions to allow particular measurements to be applied. |

|

Respond to customer needs through customer service and product design and communications |

CPA often features a customer interaction based on chatbot conversations. The power of chatbots is the potential to offer a personalised journey for every customer. Therefore, a vulnerable customer would have every interaction exclusively tailored to them. |

|

Monitor whether they are meeting the needs of vulnerable customers and take action |

CPA can highlight all the conversations that were labeled by the chatbot as “vulnerable” and interpole them with customer satisfaction scores and verbatim feedback to inform businesses on performance over conversations with vulnerable customers. |

Michael Sicsic, Spixii advisory board member and former head of supervision at the FCA said:

“Firms struggle most with design and organisation change necessary to identify, track and use the most relevant customer information. Communications to vulnerable customers needs to be tailored –with different trigger points and different wording according to circumstances. The more information a customer shares, the better the organisation is able to respond, and mitigate the impacts of a customer’s degree of vulnerability.

At the same time, relevant data on vulnerability must be systematically collected and recorded so it can be used by frontline staff. Chatbots and Conversational Process Automation (CPA) can support insurance firms to achieve both goals, the best customer and business outcomes.”

In action: a chatbot’s power to help a vulnerable, elderly woman

In 2018, Spixii designed a multi-award winning expert chatbot system called Zara for Zurich UK to help them manage their claims. Anne’s entire testimonial using the expert chatbot can be viewed below where she also explains the context of filing for the claim.

From our experience, we also observed frequent feedback from the vulnerable customers before it was a topic of interest for the FCA. Some anonymised feedback using Spixii expert chatbots for several insurers include:

- I'm deaf and struggle on the phone. Also I have severe anxiety so phone conversations are hard so using this service changed my life.

- I am quite old and I don't find phone conversations easy.

- Logging a claim online has been so easy, I was really anxious at how difficult it would be. It is so much easier than an automated system logging over the telephone.

There are thousands of vulnerable people like Anne who are deprived of receiving proper financial services and security because of different factors like the ones in the infographic above. As providers, it is an ethical and moral duty to be inclusive and design businesses that cater for their wellbeing, too.

While FCA’s new requirements present a new vision, Conversational Process Automation has the ability to bring that vision to life. You can discover more about Conversational Process Automation here and read some recent blog posts about what CPA exactly is and how it can help to prevent chatbots’ failure.