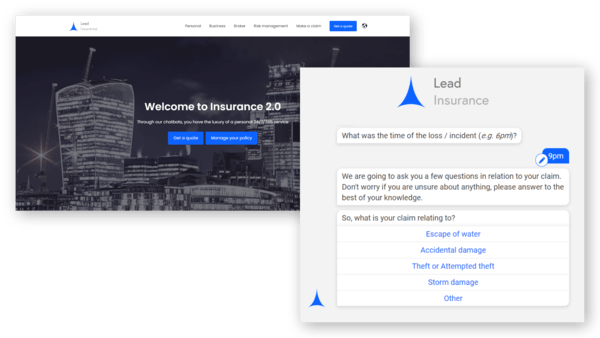

Claims processes represent the ‘moment of truth’ for insurers and their customers. The same goes with the information related to benefits. Most claims and benefits information are currently discussed by phone. Call centres saturate quickly, especially during surges, creating high operational costs and waiting on hold for customers.

Actual use cases of automation of high-value processes for Claims & Benefits include:

Open up to significant savings by embracing conversational process automation of high-value processes

Through the Function Manager, leverage pre-built integrations to leading core platform and RPA providers

Raise the standard of your customer support with 24/7/365 available self-serve delivering outcome in less than 3 minutes on average

Request a demo with our sales team to get the solution overview.

Allow your customers to notify their loss straight through Spixii Expert Chatbots at their most convenient time whilst sparing them the hassle of queuing on the phone

Perform or improve existing the fraud check and claim triage through Spixii Experts Chatbot by identifying “fast track” to process and complex claims to route to trained claim handlers

If the completed conversational process triggers all the green flags of your business logic then automated decisions can be done at scale in a secure and repeatable manner

Using the Spixii secure content management system, your customer can upload media such as photo, invoice and video avoiding unnecessary back and forth

Validate user information upfront by connecting with APIs able to check existing number plates

Measure your customer satisfaction rate using CSAT, TNPS or CES and gather feedback to understand how to improve your solution

Collect more accurate customer details by introducing specific validation rules for email, postcode, telephone number etc.

See how Zurich UK launched their first FNOL claims chatbot in just 5 weeks leveraging Spixii CPA and how it managed to absorb the Beast from the East surge.

Spixii Intelligent Chatbots gather all the FNOL details and the through the Function Manager log them straight into Appian Connected Claims, where the operational claim team have a 360-degree view of each claim in an actionable dashboard of data from all claims systems, policy systems and 3rd party applications.

Spixii Claim solution and Duck Creek Claim communicates in both directions to allow the capture of information, update of loss and resolution of claims for all lines of businesses such as property and motor.

Spixii Intelligent Chatbots allow to notify a claim with media in a few minutes, and through a Blue Prism connector can be integrated with the policy system to retrieve customer’s policy data and allow automated claims updates after the FNOL.

From core systems to RPA, Spixii partners with the leading technology providers to offer end-to-end digital solutions.

Spixii partnered with Appian to offer insurers an embedded solution that enables straight-through-processing (STP) and no-touch claims automation for P&C, Health and Life insurance.

Socotra provides open APIs, a product-agnostic data model, and out-of-the-box capabilities to manage the entire policy lifecycle, making insurance innovation faster, easier, and more affordable.

Blue Prism develops leading Robotic Process Automation software to provide businesses with a more agile virtual workforce. Spixii complements it through the automation of conversations.

As a pure B2B2C solution, Spixii believes in the value of reconciling customer and business needs. Once live we offer premium hands-on support for 6 weeks accelerating the benefits gained by your business thanks to the Spixii Claims Solutions.

Discuss your business needs with the Spixii team and discover how the Spixii CPA Platform can help you accelerate the automation of your high-value processes.